What is an Equity Share?

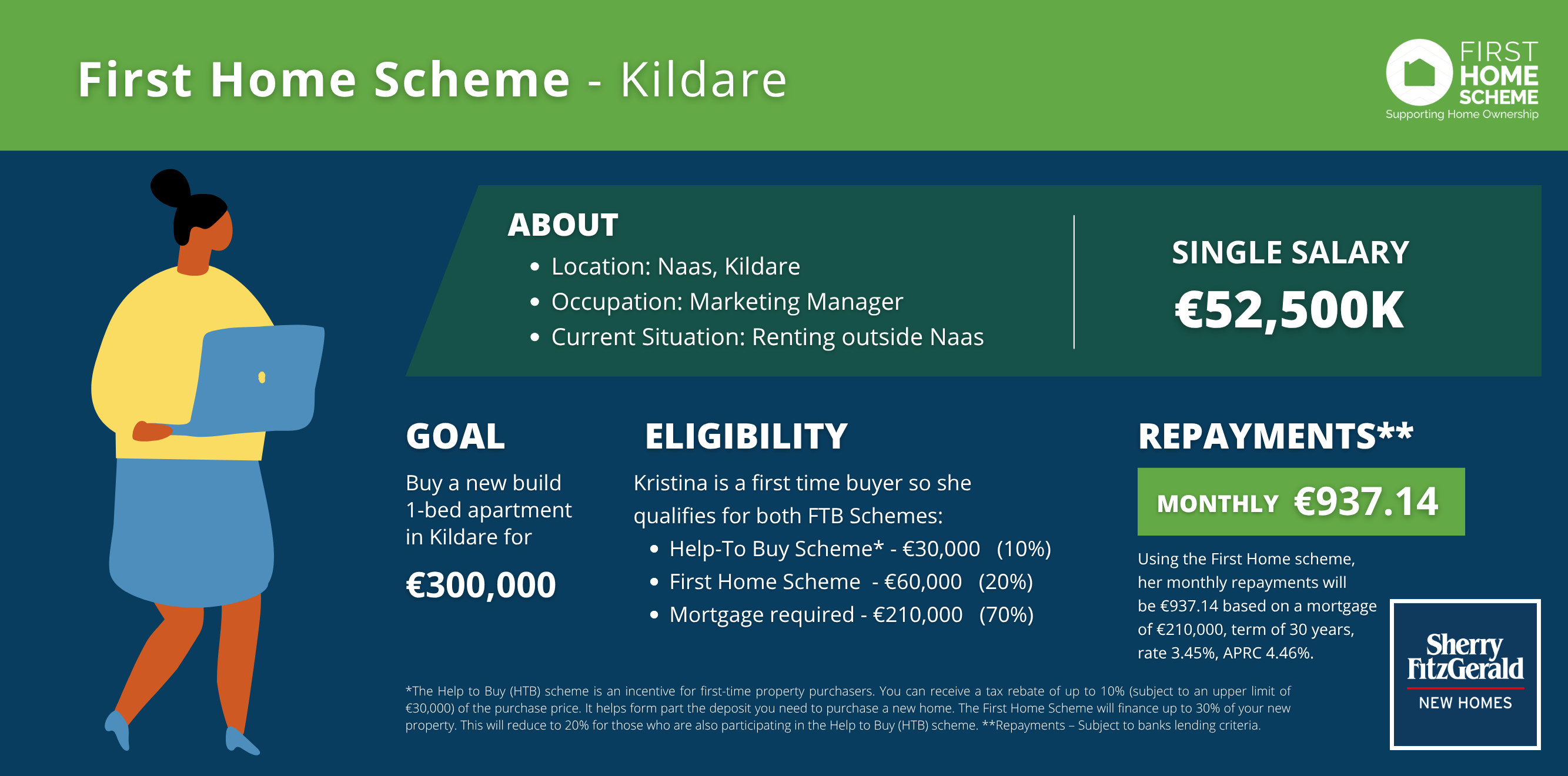

This new scheme will provide funds to enable the purchase and will take an equity share in the home at the same percentage. As an example, if the First Home Scheme provides 20% of the funds for the purchase, it will take a 20% equity interest in the home. You will either pay back the equity interest in partial redemptions each year, or when you come to sell. As the equity share will be tied to the property (as a percentage), the actual amount will fluctuate. So if your property grows in value, the amount you owe will also grow.

Who is Eligible to Apply?

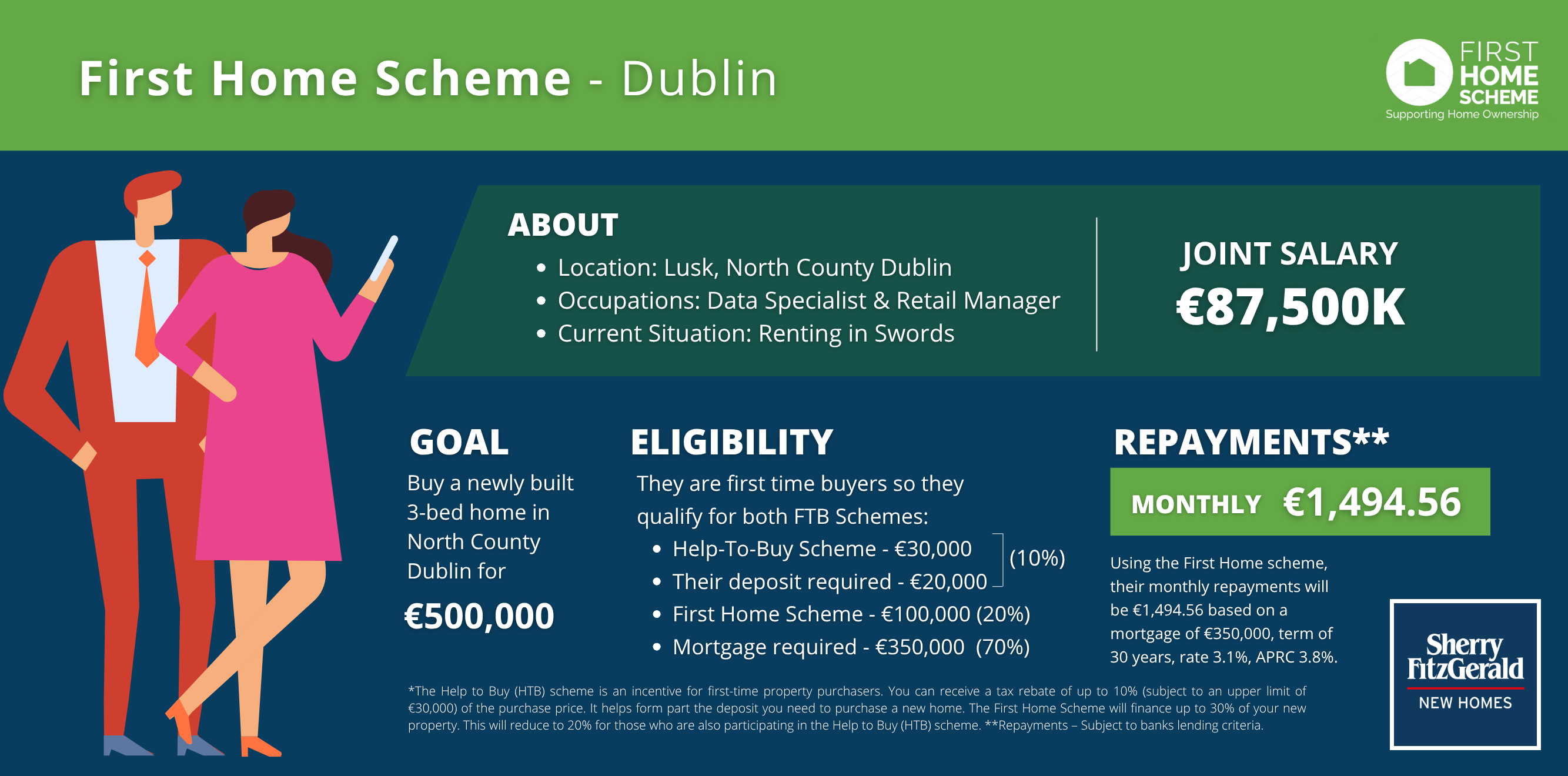

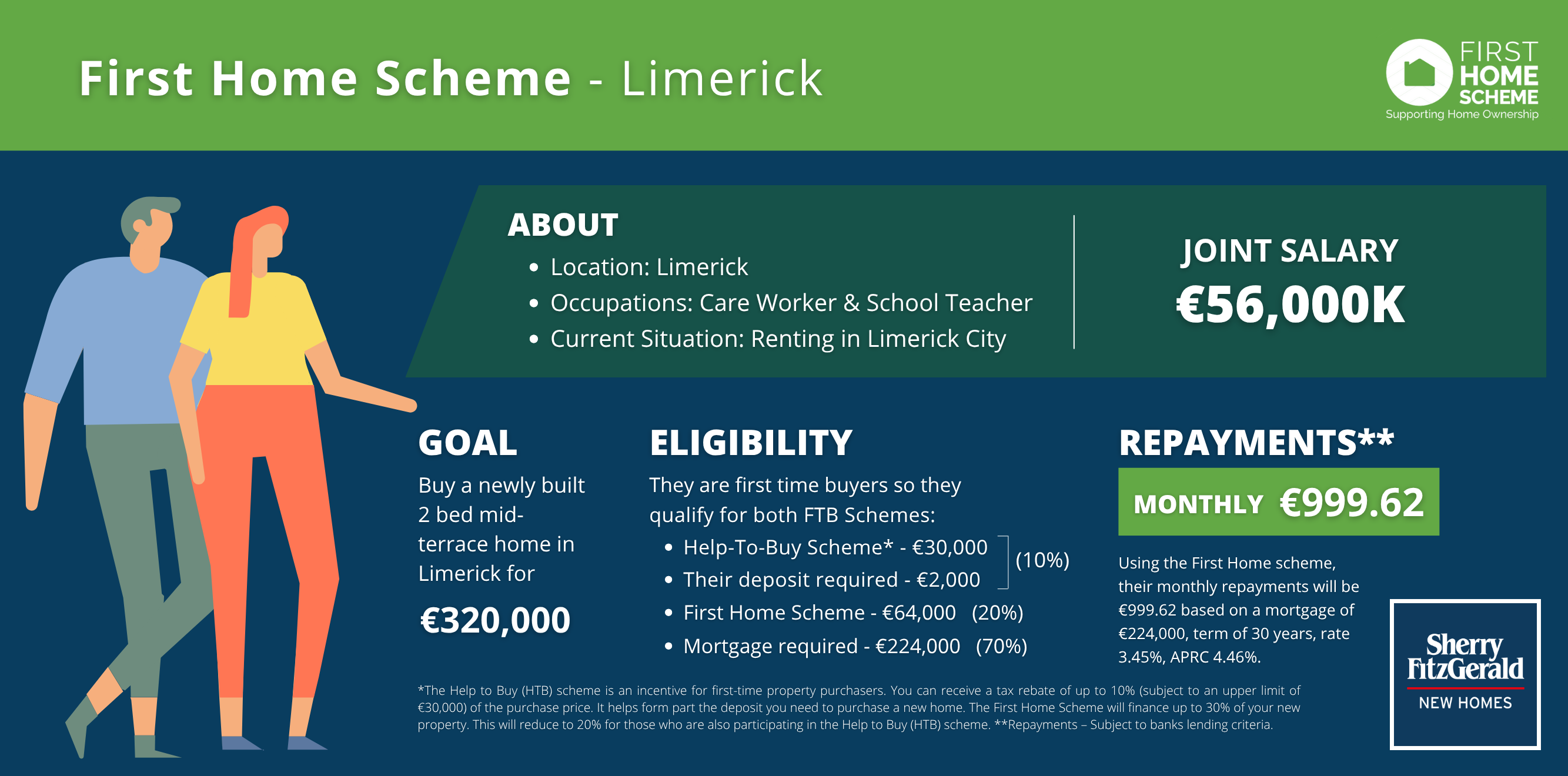

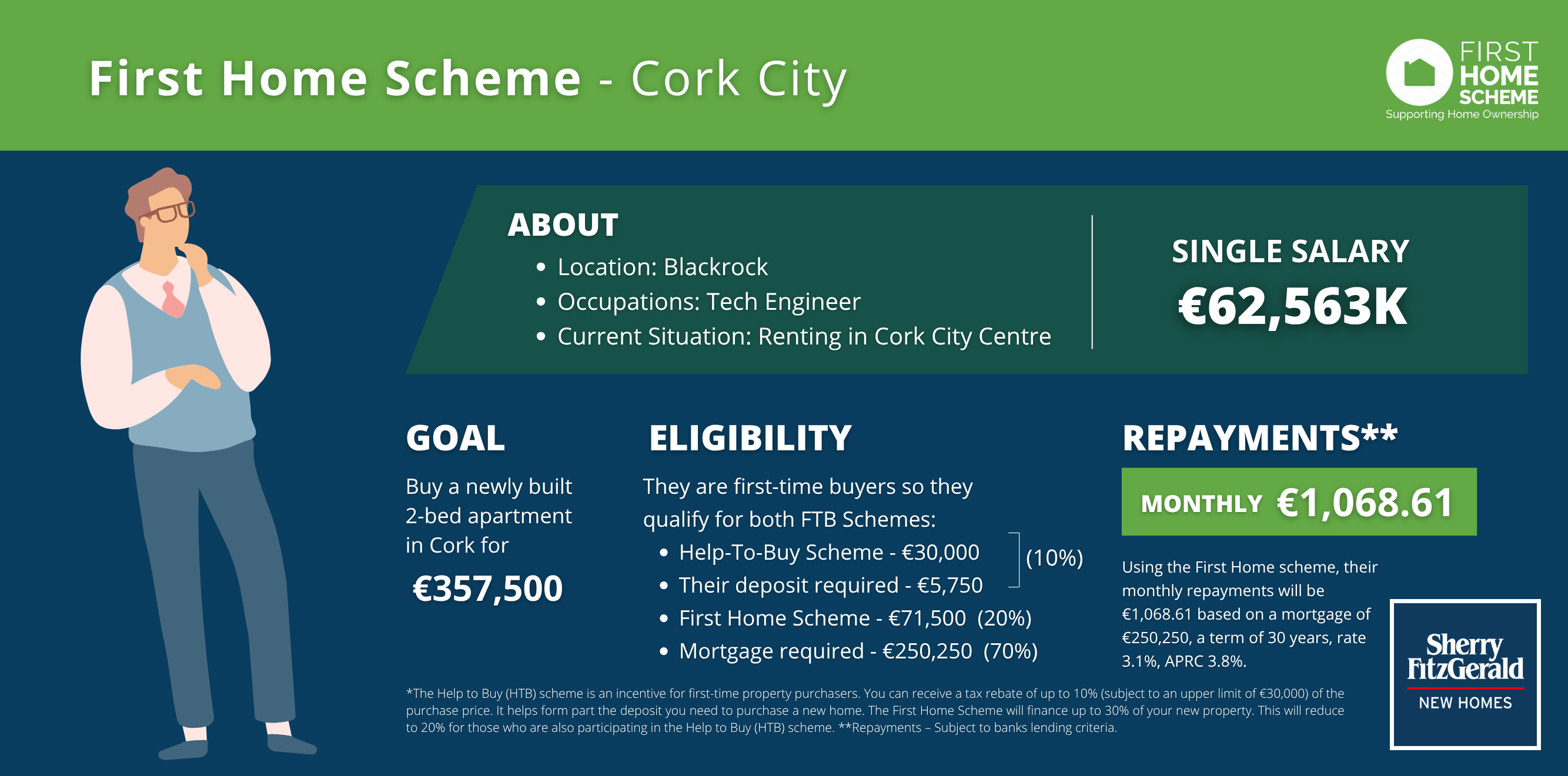

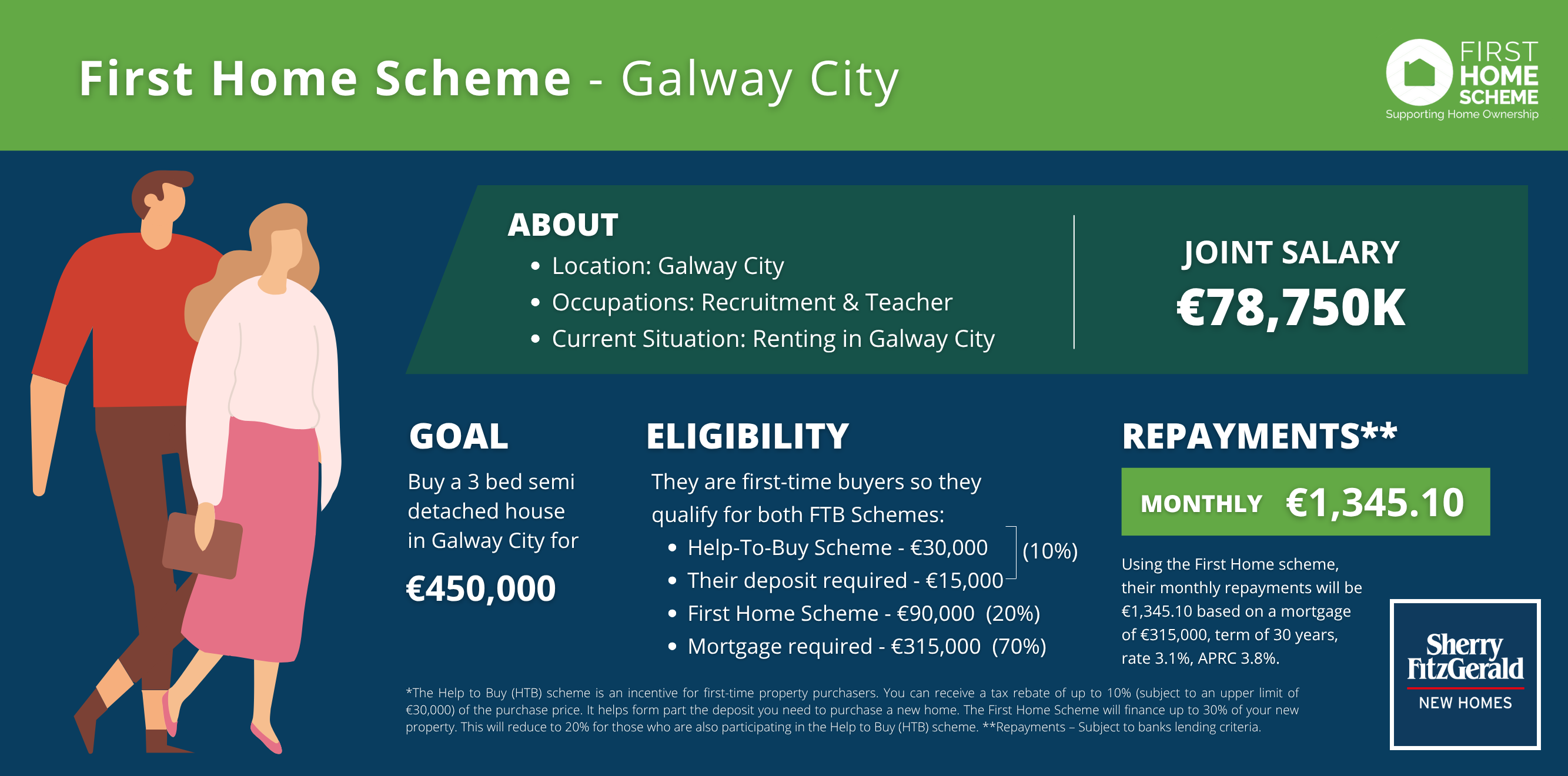

The First Home Scheme is primarily targeted at first-time buyers who are seeking to buy a newly constructed home, but who cannot secure the full amount required from their mortgage and deposit.

Under the Government’s ‘Fresh Start’ principle, people who are separated or divorced or whose relationship has ended, or who have undergone insolvency proceedings and have no interest in their former home, will also be eligible to apply for support through this Scheme.

To find out if you are eligible for the First Home Scheme, please visit the First Home Scheme eligibility calculator here.

Fees and Charges

Unlike a mortgage, there is no charge for the equity share for the first five years of this scheme. From the beginning of year six, if the equity share is still in place, a service charge will apply. This is a charge to be paid by you to the Government for the maintenance and servicing of the First Home Scheme.

This service charge will be applied to the equity share from the start of year six onwards at the following rates per annum:

- 1.75% for year six - year 15

- 2.15% for year 16 - year 29

- 2.85% for year 30+

For further information on these fees and other FAQs, please visit https://www.firsthomescheme.ie/faqs/fees-and-charges/

How to Apply

For more information on the First Home Affordable Purchase Shared Equity Scheme, please click here