Terms of Business

These Terms of Business set out the general terms under which our firm will provide business services to you and the respective duties and responsibilities of both the firm and you in relation to such services. Please ensure that you read these terms thoroughly and if you have any queries, we will be happy to clarify them. If any material changes are made to these terms, we will notify you.

Authorisation with the Central Bank of Ireland

Mortgage Insight DAC t/a Sherry FitzGerald Financial Services, Sherry FitzGerald Mortgages (C3226) is regulated by the Central Bank of Ireland as an insurance intermediary registered under the European Union (Insurance Distribution) Regulations 2018; as an Investment Intermediary authorised under the Investment Intermediaries Act, 1995 as amended and as a Mortgage Credit Intermediary authorised under Regulation 30 of the European Union (Consumer Mortgage Credit Agreements) Regulations 2016. Mortgage Insight DAC t/a Sherry FitzGerald Financial Services, Sherry FitzGerald Mortgages is part of the Sherry FitzGerald Group. Copies of our regulatory authorisations are available on request. The Central Bank of Ireland holds registers of regulated firms. You may contact the Central Bank of Ireland on 1890 777 777 or alternatively visit their website at www.centralbank.ie to verify our credentials.

Codes of Conduct

Mortgage Insight DAC t/a Sherry FitzGerald Financial Services, Sherry FitzGerald Mortgages is subject to the Consumer Protection Code, Minimum Competency Code, Fitness & Probity Standards and Handbook of Prudential Requirements for Investment Intermediaries which offer protection to consumers. These Codes can be found on the Central Bank’s website www.centralbank.ie

Description of Services

Mortgage Insight DAC t/a Sherry FitzGerald Financial Services, Sherry FitzGerald Mortgages is a member of Brokers Ireland & AIMA.

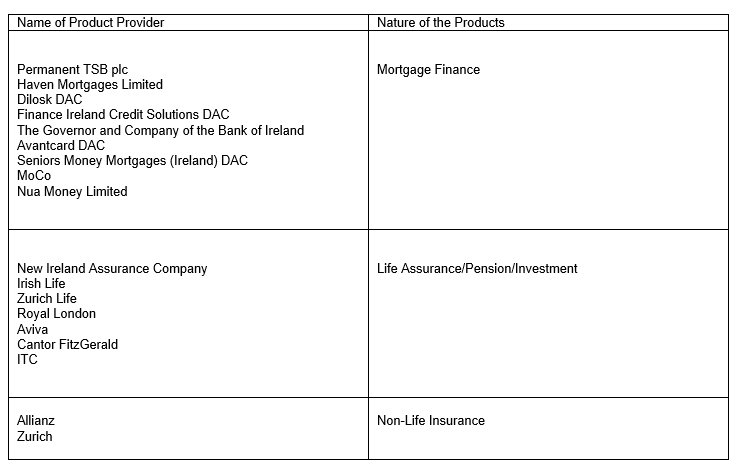

Mortgage Insight DAC t/a Sherry Fitzgerald Financial Services, Sherry FitzGerald Mortgages offer advice in relation to all aspects of mortgage finance,life assurance products (Term Cover, Serious Illness) and General Insurance, Pensions and Investments. Recommendations given by Mortgage Insight DAC t/a Sherry FitzGerald Financial Services, Sherry FitzGerald Mortgages are based on our understanding of the market today, factors influencing our recommendations may change over time and Mortgage Insight DAC t/a Sherry FitzGerald Financial Services, Sherry FitzGerald Mortgages cannot be responsible for keeping clients informed of any future changes. It is important to note we transmit orders on client’s behalf to any of the insurance undertakings or product producers from whom the Company hold letters of appointment. A list of all such entities is contained elsewhere in these Terms of Business. Our firm provides advice on a fair analysis of the market for mortgage finance and assurance products. “Fair and personal analysis of the market” means that our firm provides its services based on a sufficiently large number of contracts and product producers available on the market to enable our firm to make a recommendation, in accordance with professional criteria, regarding which contract would be adequate to meet our client’s consumer’s needs. When our firm provides non-life services to client’s we provide this service on a limited analysis basis meaning that our firm provides non-life services based on a limited number of contracts and product producers available on the market. Mortgage Insight DAC t/a Sherry FitzGerald Financial Services, Sherry FitzGerald Mortgages cannot be held responsible for any underwriting policies with the lending institutions or insurance companies we hold agencies with these policies are a matter for the respective institutions. Approval in Principles/Loan Offers are subject to change, Mortgage Insight DAC t/a Sherry FitzGerald Financial Services, Sherry FitzGerald Mortgages take no responsibility for any decision by a lender to amend or revoke a formal or informal offer from lending institutions or insurers.

If you are being recommended/provided with a Serious Illness product, please pay attention to all policy documentation issued to you, the restrictions, conditions, and general exclusions that are attached to the policy.

Sustainability Factors –

In accordance with the Sustainable Finance Disclosure Regulation (SFDR), we inform you that when providing advice on insurance-based investment products/investments, we assess, in addition to relevant financial risks, relevant sustainability risks as far as this information is available in relation to the products proposed/advised on. This means that we assess environmental, social and governance events/conditions that, if they occur, could have a material negative impact on the value of the investment. We integrate these risks in our advice by reviewing provider literature in relation to sustainability risks, we liaise with the providers in relation to any queries in relation to the funds. This information is reviewed by us on an ongoing basis. In addition, when providing investment advice, we assess the Principle Adverse Impacts information published by product manufacturers by examining the product providers literature to establish the Principle Adverse Impacts for the relevant products. We will then compare financial products across available providers to make informed investment decisions about the suitability of ESG products. We also assess the likely impacts of sustainability on the returns of the investment on which we advise.

Remuneration Policy

Life Assurance

Mortgage Insight DAC t/a Sherry Fitzgerald Financial Services, Sherry FitzGerald Mortgages is remunerated by commission from product producers. When assessing products, we will consider the different approach taken by providers in terms of them integrating sustainability risks in their product offerings, This will form part of our analysis for choosing a product provider. We take due care so that our internal remuneration policy with respect to investment advice promotes sound and effective risk management in relation to sustainability risks and does not encourage excessive risk-taking with respect to sustainability risks.

A summary of the details of all arrangements for any fee, commission, other reward or renumeration paid or provided to us which have been agreed with product providers is available on our website www.sherryfitz.ie.

Mortgage Business

Mortgage Insight DAC t/a Sherry Fitzgerald Financial Services, Sherry FitzGerald Mortgages is in receipt of mortgage commissions from lenders at a rate of up to 1% of the value of the amount borrowed, details will be included in your Mortgage Statement of Suitability document. A list of lenders whom Mortgage Insight DAC t/a Sherry Fitzgerald Financial Services, Sherry FitzGerald Mortgages hold agencies with is listed in this document.

Mortgage Insight DAC t/a Sherry Fitzgerald Financial Services, Sherry FitzGerald Mortgages may make sub-commission payments to Introducers of mortgage business to the company. All recipients of such sub-commission payments must be registered by the Central Bank of Ireland as a Mortgage Intermediary.

Fees and Charges

Mortgage Insight DAC t/a Sherry FitzGerald Financial Services, Sherry FitzGerald Mortgages charges a once off application fee of a minimum of €195 which is non-refundable for a mortgage application. Clients of Mortgage Insight DAC t/a Sherry FitzGerald Financial Services, Sherry FitzGerald Mortgages have the option of dealing with us on a fee only basis for the services we provide.

Financial Review

Mortgage Insight DAC t/a Sherry Fitzgerald Financial Services, Sherry FitzGerald Mortgages in the case of Full Financial Reviews where the firm is not in receipt of commission, will charge a service fee, agreed with clients, depending on complexity of the transaction, time spent and nature and extent of the transaction.

General Insurance

Mortgage Insight DAC t/a Sherry FitzGerald Financial Services, Sherry FitzGerald Mortgages is paid for the service we provide to clients by means of a remuneration agreement, details of the commission arrangements are available on our website.

Regular Reviews

It is in your best interests that you review, on a regular basis, the products which we have arranged for you. As your circumstances change, your needs will change which may result in you having insufficient cover and/or inappropriate investments. We would therefore advise that you contact us to ensure that you are provided with up-to-date advice and products best suited to your needs.

Consumers: Duty of Disclosure when completing documentation for new business

Section 14 (1) – (5) of the Consumer Insurance Contracts Act which is effective from the 1st September 2021 alters consumers duty of disclosure:

- You are required to answer all questions posed by us or the insurer honestly and with reasonable care – the test will be that of the ‘average consumer’. Average consumer as per Directive No 2005/29/EC of the European Parliament and of the Council of 11 May 2005 is reasonably well informed and reasonably observant and circumspect, considering social, cultural, and linguistic factors.

- Specific questions will be asked. Where you do not provide additional information (after being requested to do) it can be presumed that the information previously provided remains unchanged.

An insurer may repudiate liability or limit the amount paid on foot of the contract of insurance, only if it establishes that non-disclosure of material information was an effective cause of the insurer entering into the relevant contract of insurance and on the terms on which it did.

Completed proposal forms

Completed proposal forms will be provided to you. This is an important document as it forms the basis of the insurance contract between the insurer and you the consumer. You should review and confirm that the answers contained within are true and accurate.

Commercial Customers Non-Consumer Disclosure of Information

It is essential that you should bring to our attention any material alteration in risk such as changes of address or use of premises. Any failure to disclose material information may invalidate your claim and render your policy void.

Conflict of interest

It is the policy of Mortgage Insight DAC t/a Sherry Fitzgerald Financial Services, Sherry FitzGerald Mortgages to avoid a conflict of interest when providing services to clients. Where an unavoidable conflict arises, we will advise you of this in writing before providing any business services. If you have not been made aware of any such conflict you may assume that none arises.

Default Remedies

Mortgage Insight DAC t/a Sherry Fitzgerald Financial Services, Sherry FitzGerald Mortgages actions in the event of default by the client are:

Product providers are entitled to withdraw benefit or cover on default of any payments due under any products arranged for your benefit. It is therefore critical to the guaranteed continuance of your insurance that your premium is paid in full. Some insurers may include as a term of the insurance a settlement due date or in some cases a warranty under the terms of which the premium must be paid to them by a certain date. We inform our clients of such requirements and the relevant date in good time to allow the payment terms to be met. Failure to comply with the terms of the warranty may mean that the insurers obligation under the policy will be terminated. Mortgage Insight DAC t/a Sherry FitzGerald Financial Services, Sherry FitzGerald Mortgages cannot take responsibility for default payments.

An outline of the action and remedies which the relevant product producers may take in the event of default by a client is included in the product producer’s policy document.

Our firm will exercise its legal rights to obtain any payments due to it from our clients.

Complaints Procedure

Mortgage Insight DAC t/a Sherry Fitzgerald Financial Services, Sherry FitzGerald Mortgages has in place a written procedure for the handling of complaints. This procedure ensures that all complaints are recorded and acknowledged within 5 business days. All complaints are fully investigated, and the complainant updated at intervals of not greater than 20 business days. We will attempt to investigate and resolve a compliant within 40 business days.

All complaints should be directed in writing to Emer McHugh, Mortgage Insight DAC t/a Sherry Fitzgerald Financial Services, Sherry FitzGerald Mortgages Unit 3 Boyne House, Custom House Square, IFSC, Dublin 1. If a client remains dissatisfied with the handling of and/or response to a complaint they may refer the matter to The Financial Services and Pensions Ombudsman, Lincoln House, Lincoln Place, Dublin 2

Data Protection

Mortgage Insight DAC t/a Sherry FitzGerald Financial Services, Sherry FitzGerald Mortgages complies with the requirements of the General Data Protection Regulation 2018 and the Irish Data Protection Act 1988-2018.

Mortgage Insight DAC t/a Sherry FitzGerald Financial Services, Sherry FitzGerald Mortgages is committed to protecting and respecting your privacy. We wish to be transparent on how we process your data and show you that we are accountable with the GDPR in relation to not only processing your data but ensuring you understand your rights as a client.

The data will be processed only in ways compatible with the purpose for which it was given and as outlined in our Data Privacy Notice; this will be given to all our clients at the time of data collection.

We will ensure that this Privacy Notice is easily accessible. Please refer to our website www.sherryfitz.ie/privacynotice, if this medium is not suitable, we will ensure you can easily receive a copy by hard copy.

Consumer responsibilities arising out of the Consumer Insurance Contracts Act 2019 which was implemented to protect consumers. Non-Consumer Commercial clients have no duties and rights under this Act, and therefore the following sections do not apply to them.

New Business & Renewal

A consumer may cancel a contract of insurance, by giving notice in writing to the insurer within 14 working days after the date the consumer was informed that the contract is concluded. The insurer cannot impose any costs on the consumer other than the cost of the premium for the period of cover. (This does not affect notice periods already in place, i.e. 30 days in respect of life policies and 14 days in respect of general insurance policies under respective pieces of legislation).

The consumer is under a duty to pay their premium within a reasonable time, or otherwise in accordance with the terms of the contract of insurance.

A court of competent jurisdiction can reduce the pay-out to the consumer where they are in breach of their duties under the Act, in proportion to the breach involved.

Post-Contract Stage & Claims

If, in respect of the insurance contract the insurer is not obliged to pay the full claim settlement amount until any repair, replacement or reinstatement work has been completed and specified documents for the work have been furnished to the insurer, the claim settlement deferment amount cannot exceed

- 5% of the claim settlement amount where the claim settlement amount is less than €40,000

- 10% of the claim settlement amount where the claim settlement amount is more than €40,000

An insurer may refuse a claim made by the consumer under a contract of insurance where there is a change in the risk insured, including as described in an ‘alteration of risk’ clause, and the circumstances have so changed that it has effectively changed the risk to one which the insurer has not agreed to cover.

Any clause in a contract of insurance that refers to a ‘material change’ will be interpreted as being a change that takes the risk outside what was in the reasonable contemplation of the contracting parties when the contract was concluded.

The consumer must cooperate with the insurer in an investigation of insured events including responding to reasonable requests for information in an honest and reasonably careful manner and must notify the insurer of the occurrence of an insured event in reasonable time.

The consumer must notify the insurer of a claim within reasonable time, or otherwise in accordance with the terms of the contract of insurance.

If the consumer becomes aware after a claim is made of information that would either support or prejudice the claim, they are under a duty to disclose it. (The insurer is under the same duty).

If the consumer makes a false or misleading claim in any material respect (and knows it to be false or misleading or consciously disregards whether it is) the insurer is entitled to refuse to pay and to terminate the contract.

Where an insurer becomes aware that a consumer has made a fraudulent claim, they must notify the consumer advising that they are avoiding the contract of insurance. It will be treated as being terminated from the date of the submission of the fraudulent claim. The insurer may refuse all liability in respect of any claim made after the date of the fraudulent act, and the insurer is under no obligation to return any of the premiums paid under the contract.

Distance Marketing Information

Information about your Distance Contract under the European Communities (Distance Marketing of Consumer Financial Services) Regulation 2004 (the ‘Regulations’).

Your right to cancel

The Regulations give clients the right to withdraw from financial services contracts entered through distance selling. If specified conditions are fulfilled the client has the right to cancel the contract within the cancellation period. This terminates the contract from the notice of termination being given. The cancellation period begins on the date of the conclusion of the contract and ends 14 days from that date. For life assurance contracts the cancellation period runs from the date the client is informed that the contract has been concluded and is 30 days instead of 14. For mortgages a client does not have the right to cancel the contract once funds have drawn down for a housing loan, but clients may repay a house loan early.

Mortgage Insight DAC t/a Sherry FitzGerald Financial Services, Sherry FitzGerald Mortgages will accept a cancellation notice from a client by post, or email which will be forwarded as soon as possible to the relevant provider.

Where a client cancels a life assurance contract, the provider will refund any sum paid by the client as soon as possible provided the cancellation request was received within 30 of the conclusions of the contract.

Investor Compensation Scheme

The Investor Compensation Act, 1998 provides for the establishment of a compensation scheme and the payment, in certain circumstances, of compensation to certain clients (known as eligible investors) of authorised investment firms, as defined in that Act.

The Investor Compensation Company Ltd. (ICCL) was established under the 1998 Act to operate such a compensation scheme and our firm is a member of this scheme.

Compensation may be payable where money or investment instruments owed or belonging to clients and held, administered or managed by the firm cannot be returned to those clients for the time being and where there is no reasonably foreseeable opportunity of the firm being able to do so.

A right to compensation will arise only:

- If the client is an eligible investor as defined in the Act; and

- If it transpires that the firm is not able to return client money or investment instruments owned or belonging to the clients of the firm; and

- To the extent that the client’s loss is recognised for the purposes of the Act.

Where an entitlement to compensation is established, the compensation payable will be the lesser of:

- 90% of the amount of the client’s loss which is recognised for the purposes of the Investor Compensation Act, 1998; or

- Compensation of up to €20,000.

For further information, contact the Investor Compensation Company Ltd at (01) 224 4955.

Credit Policy

We regret that credit cannot be extended to clients in respect of premiums, initial, renewal or additional. Initial or first premiums must be paid at inception of cover and renewal premiums before the policy renewal date otherwise the Company will advise the insurance undertaking or product producer involved and cover will be cancelled.

Receipts

Mortgage Insight DAC t/a Sherry Fitzgerald Financial Services, Sherry FitzGerald Mortgages will issue receipts for each payment received pursuant to Section 30 of the Investment Intermediaries Act 1995 and such receipts will be retained in a safe place.

June 2024